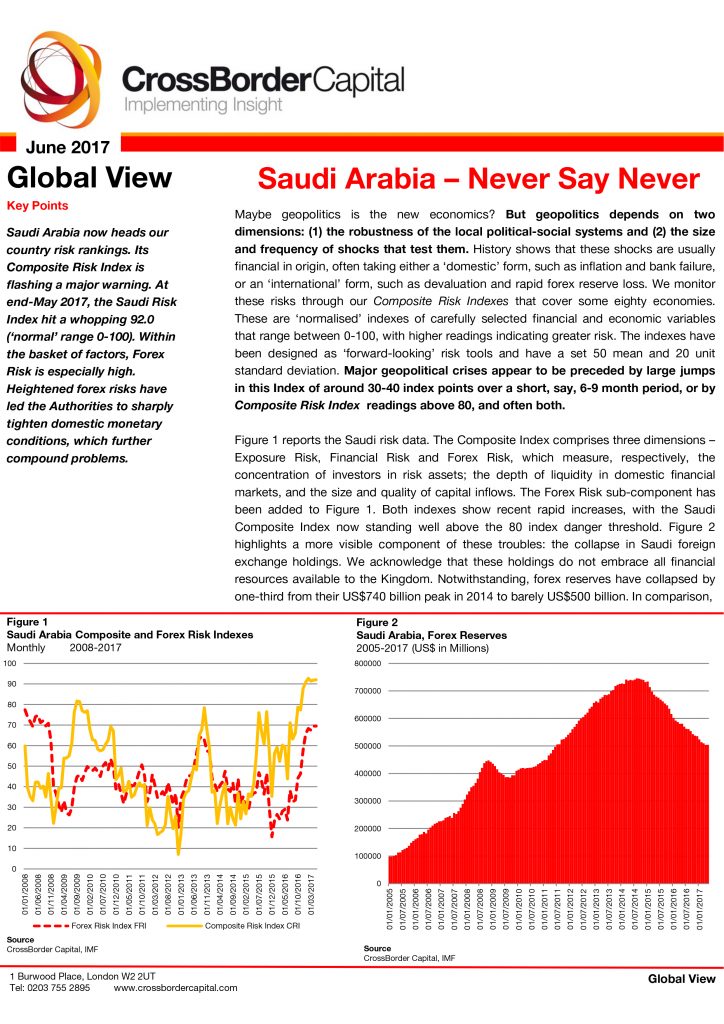

Maybe geopolitics is the new economics? But geopolitics depends on two dimensions: (1) the robustness of the local political-social systems and (2) the size and frequency of shocks that test them. History shows that these shocks are usually financial in origin, often taking either a ‘domestic’ form, such as inflation and bank failure, or an ‘international’ form, such as devaluation and rapid forex reserve loss. We monitor these risks through our Composite Risk Indexes that cover some eighty economies. These are ‘normalised’ indexes of carefully selected financial and economic variables that range between 0-100, with higher readings indicating greater risk. The indexes have been designed as ‘forward-looking’ risk tools and have a set 50 mean and 20 unit standard deviation. Major geopolitical crises appear to be preceded by large jumps in this Index of around 30-40 index points over a short, say, 6-9 month period, or by Composite Risk Index readings above 80, and often both.

Download The Research As (PDF)